Season 7, Post 43: Learning from Genghis

Your author was privileged to attend an economics conference in London last week featuring a range of high-profile speakers. Beyond the usual conversations about macro and asset allocation strategies, there was some fascinating debate about stablecoins. We learned from two different presenters why and how stablecoins will become a foundational building block for the 21st century economy.

For those unfamiliar, a stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency like the US dollar or a commodity like gold. Stablecoins operate as tokens issued on existing blockchains (decentralised digital ledgers), which enforce transactions and ownership algorithmically.

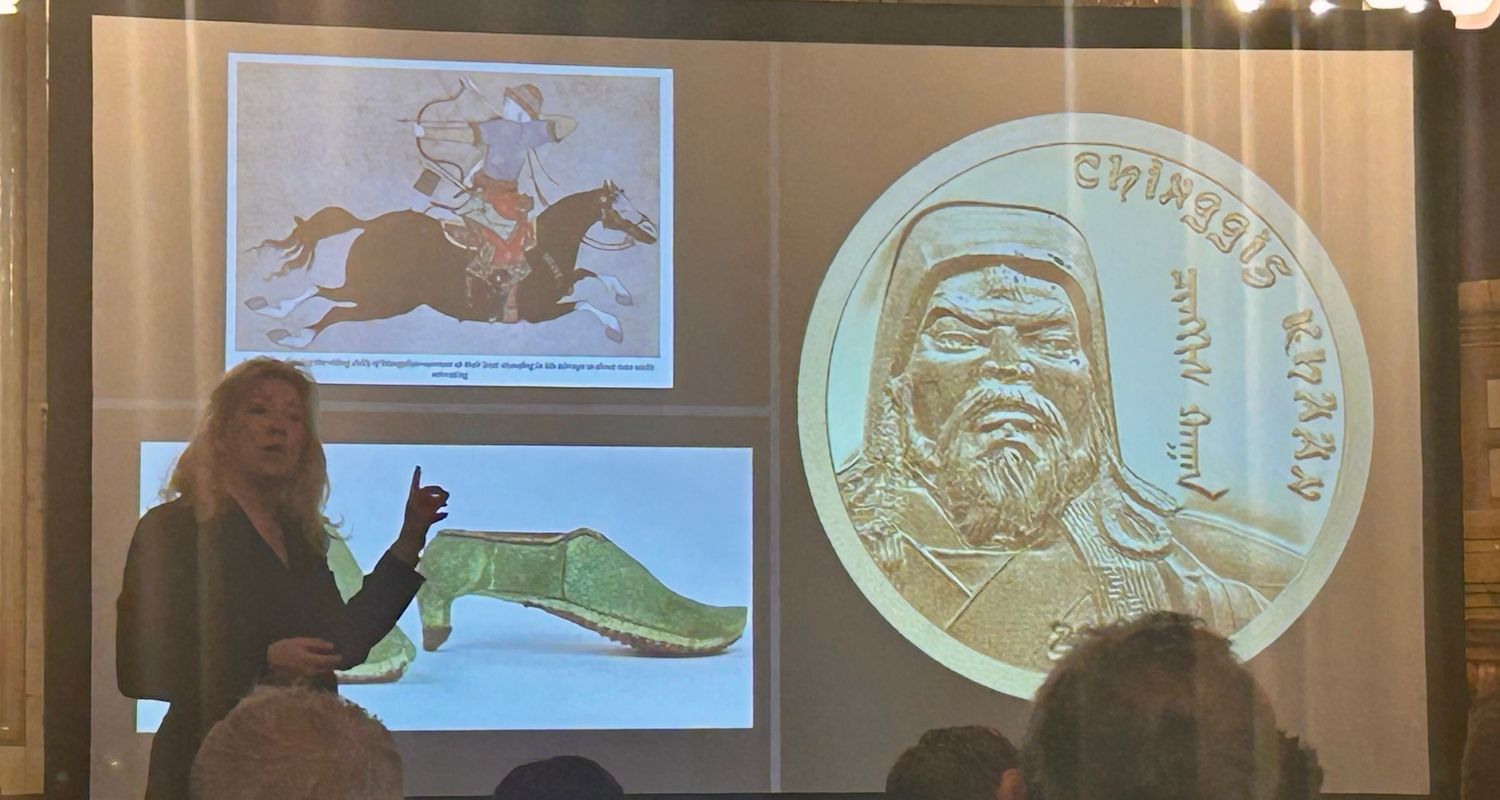

In the view of Pippa Malmgren, an American economist and technology entrepreneur whom we also featured in post 25, stablecoins will be one of the crucial tools used by the Trump administration in order to expand its global presence. Ms Malmgren asserted that just as Genghis Khan had succeeded in creating the largest empire in history via a combination of blitzkrieg technology and the enforced acceptance of Mongolian currency, so a similar approach is being attempted today.

While the Mongols invented metal stirrups that allowed their riders to fight more effectively and so conquer large swathes of the planet, so team Trump has effectively partnered with Silicon Valley with a similar end in mind. Put another way, the combination of AI with stablecoins will help drive global dominance. 'Trust the code' has become the new normal in both Silicon Valley and Washington DC. The next part of the equation (apparently advocated by Scott Bessent, the US Treasury Secretary) is to use decentralised finance to refinance the US sovereign balance sheet and reduce the country’s debt burden.

It's a compelling world view, even if the line of argument is complex and requires a certain amount of techno-optimism. Nonetheless, stablecoins could act as “a way to grow Dollar hegemony.” This was the view of Anthony DeMartino, the CEO and co-founder of Sentora, a provider of DeFi and risk management solutions, who also spoke at the conference. Admittedly, he has a vested interest. However, he highlighted the importance of the GENIUS Act (which we profiled in post 27) as a mechanism for legitimising stablecoins.

We are sympathetic to the view that stablecoins have little to do with “crypto bros” (a term used by Mr DeMartino) and how the real war lies between the commercial banking ecosystem and the consumer economy. It’s hard to know what Genghis Khan may have thought of this, but consider how in a world of stablecoins, the current ~3% fee charged by credit card companies on payments disappears. Bigger picture, tokenisation promises instant settlement, potentially unleashing of significant capital. For more on this very real possible revolution, look out for our first theme piece of 2026, which will profile this topic in depth.

11 November 2025

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click to here view all Blog posts.

Photo taken by author

Alex Gunz, Fund Manager

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)

.jpg)