Season 7, Post 1: Ahead of the future

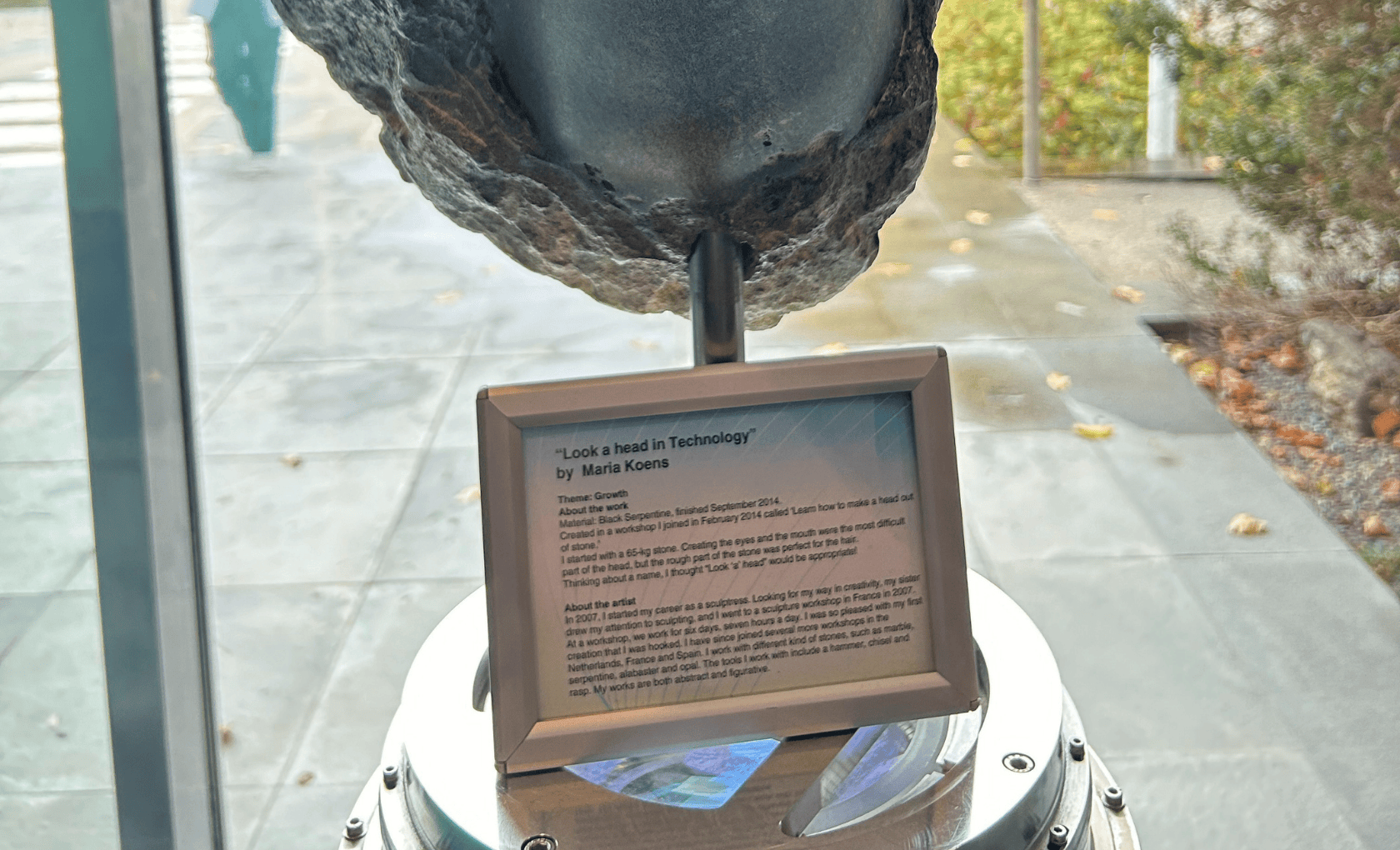

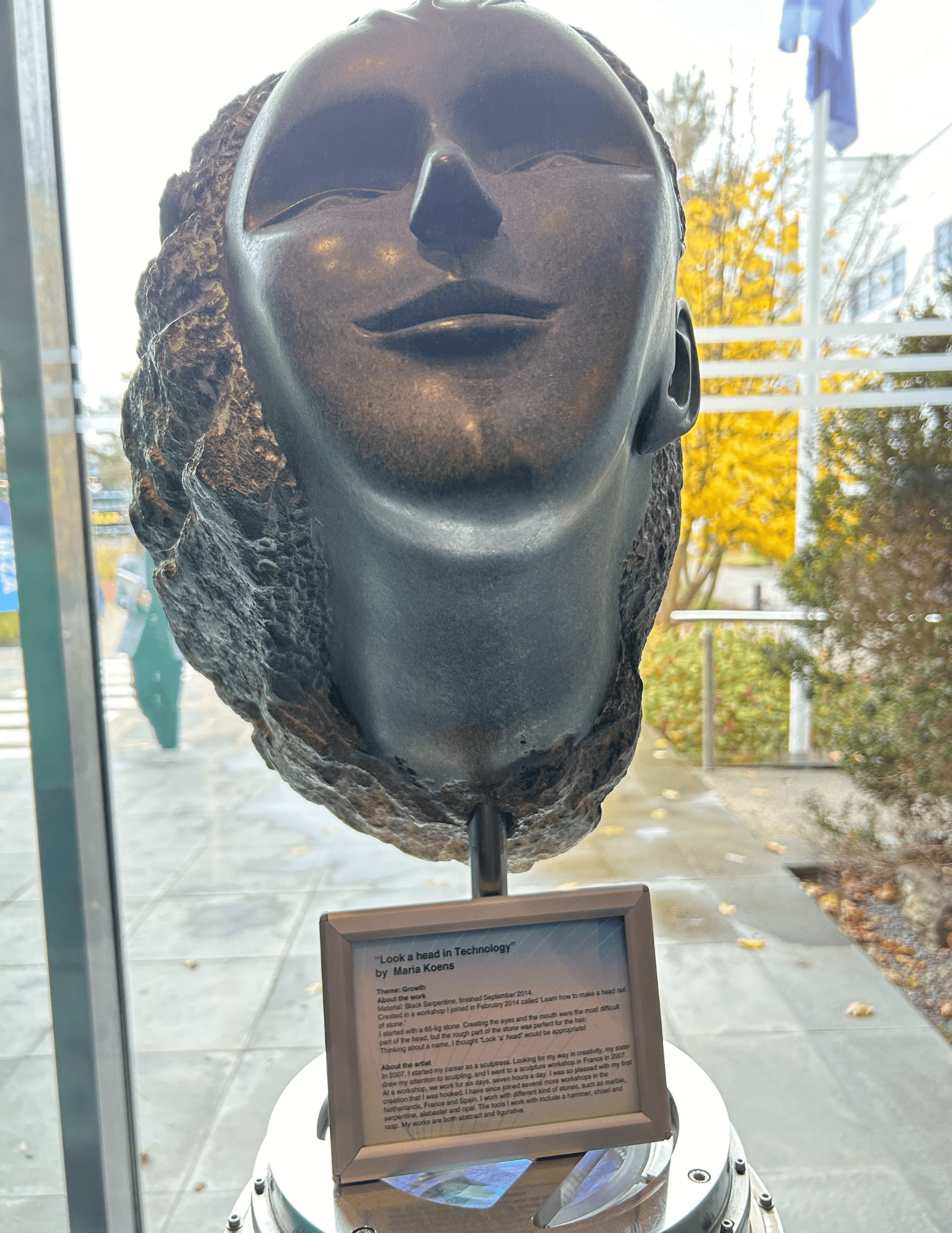

Happy New Year to all our readers, welcome to 2025 and the seventh season of the Future Trends Blog. Our mantra, since inception, is to endeavour to remain ahead of the future. Our very first Blog referenced Jeff Bezos and his “day one” mindset. We begin season seven where we started season six: at ASML’s headquarters in Veldhoven. When your author last visited, in November 2024, he was impressed by the sculpture in the company’s lobby, pictured below.

Beyond being a wonderful play on words (read the inscription below the art work), the more serious consideration is how, practically, to stay ahead of the future. Being curious is an obvious starting point. Travelling widely and engaging with a series of expert stakeholders (as we have done consistently) also helps. Another consideration may be leveraging technology to its fullest potential. We have long argued that technology is a means to an end, an enabler to help drive efficient resource allocation.

No technology has dominated headlines more in the last year than AI, and we expect 2025 to be little different (even if we may hear quite a bit more about quantum too). However, the gap between expectations and reality around what AI can practically do continues to widen, in our view. Adoption will also likely remain uneven, we believe.

Advocates will naturally assert that every white-collar worker will soon have an AI copilot or similar. This could, in theory, drive meaningful productivity gains and provoke a golden era of sales. If all works well, AI agents would be able to insert ‘themselves’ upstream from any incumbent system of record, ingest data from disparate sources, and use it to streamline hours of repetitive tasks. Virtual sales development representatives might be able to collect all relevant information on potential customers and manage initial outreach, even before creating a record in an existing system (such as a CRM). Software as a service business models, watch out! A study by OpenAI and the University of Pennsylvania found that with access to an LLM, about 15% of all worker tasks in the US could be completed significantly faster at the same level of quality.

Your author’s experience remains somewhat more mixed. In late December he spent time along with some of his colleagues on a training course targeted at developing Copilot skills. He was told that we were among the earliest adopters, a claim that might be borne out by the lack of breadth covered in the training course (even assuming a degree of computer literacy at the outset). Copilots are exciting, but they are hardly a panacea. Nonetheless, ‘artificial intelligence engineer’ is apparently the fastest growing job role in the US currently, followed by ‘artificial intelligence consultant’ (per a recent LinkedIn study). We will seek to stay ahead of the future and identify the next big things, whether in AI or elsewhere.

8 January 2025

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Heptagon Capital is an investor in ASML. The author of this piece has no personal direct investment the business. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click to here view all Blog posts.

Alex Gunz, Fund Manager

Photos by the author

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)