Season 6, Post 38: Sightseeing with salmon

It was planes, trains and automobiles for your author as he travelled over 900km from London to remote Norway. This was followed by boats, boats and more boats. There was a purpose to this lengthy journey: a highly privileged opportunity to see how the life of the salmon evolves before it finds its way onto your plate. The host was MOWI, the world’s largest producer of Atlantic salmon. It serves an estimated 2.9bn meals annually, or the equivalent of 1 in 5 salmon consumed globally.

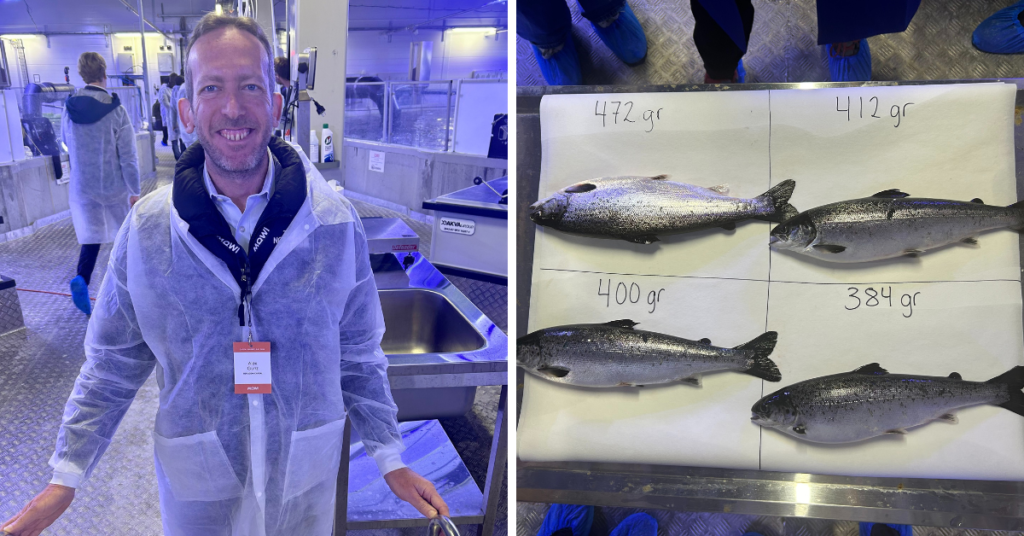

Our first stop was Nordheim, where Norway’s biggest post-smolt site is located. For the unfamiliar, a smolt is a young salmon, typically in the phase of its life before being ready to migrate to the sea. At MOWI, the young fish spend up to 50 weeks in temperature-controlled tanks in ultra-violet lit rooms. Each of the eight tanks we saw can hold up to 250,000 baby salmon. They are 5 metres deep and contain 5,800 cubic litres of water. Here, the salmon can attain a weight approaching 500g (harvested salmon may weigh as much as 5kg). The rationale for such an approach is lower mortality rates, fewer treatments and faster growth.

The 6,000 tonnes of fish produced annually at the Nordheim site may sound like an impressive figure, but for context, this volume can be equivalent to that found in just one seawater salmon farm. MOWI has around 100 of these in Norway. While there is a clear logic in further post-smolt investments across the industry, improving conventional salmon farming needs to be front of mind. It was therefore interesting to learn about the smart farming initiatives being undertaken at Bremnessvaet – which we visited – and across the broader group. MOWI (and its peers) are “trying to digitalise more and more of the value chain”, in the words of our host. This entails remote operations centres, automated monitoring and feeding systems, data analysis and more. At the Bremnessvaet site alone, over 20,000 data insights may be captured on any given day. The name of the game: efficiency and ultimately healthier salmon.

Our boat then took us to Jøsnøya, a journey similar to that which the harvested salmon might make. This major processing plant – where no photos were permitted – sees 150 fish processed a minute, equivalent to between 40 and 50 boxes, ready to be sent to wholesale. Each will contain up to 25kg of fish. The site handles over 530,000 tonnes of salmon annually, with a theoretical ceiling some 15% higher. It was hard not to be impressed by the level of automation evident throughout the process and the relatively few employees on site.

The salmon industry should be the beneficiary of multiple overlapping future trends that include population growth, health and resource efficiency, all of which we have discussed in the past. MOWI announced last week plans to accelerate its salmon production to account for growing demand, which we believe will continue to outstrip supply. In the words of MOWI, salmon has the potential to become “the food icon of the 21st Century.”

3 October 2024

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Heptagon Capital is an investor in MOWI. The author of this piece has no personal direct investment in the business. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click here to view all Blog posts.

Alex Gunz, Fund Manager

Photos by the author

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)