Season 6, Post 25: Money on the move

How many times a day do you swipe or tap? A lot, probably. Mastercard’s network processes over 60,000 transactions a second on its network at peak times of the year, such as Black Friday. Digital payment may be utterly commonplace for all readers of this piece, but your author was reminded of the sheer complexity that underpins this process when recently visiting Mastercard’s London Experience Centre.

Mastercard has seven such Centres around the world (we have visited the New York one several times). It uses them to showcase innovation to stakeholders. In homage to one of Britain's most famous fictional creations, at the heart of the London Centre sits the ‘Bond Room.’ It was fittingly equipped with a huge screen displaying the full extent of Mastercard’s global network. The company’s underlying decision intelligence platform reviews around 2bn transactions daily. Backed by more than 100 different AI models, 200,000 fraud criteria are considered before any transaction is approved (or declined). This process takes just 50 milliseconds, on average. Great news for retailers seeking to minimise fraud risks.

No wonder then that the number of merchant acceptance locations at Mastercard have expanded significantly in recent years. Payments on the Mastercard network are accepted in over 110m locations globally, with 20m added in the last three years. This is equivalent to one every three seconds. Payment facilitation via the likes of Square and SumUp have helped, but for consumer, the frictionless use of Mastercard also matters. Contactless payments now account for more than 1-in-2 in-person transactions globally. Tokenisation, via the use of biometric-enabled Apple ID, for example, has been another important driver. More small business (and their customers) will likely embrace these technologies.

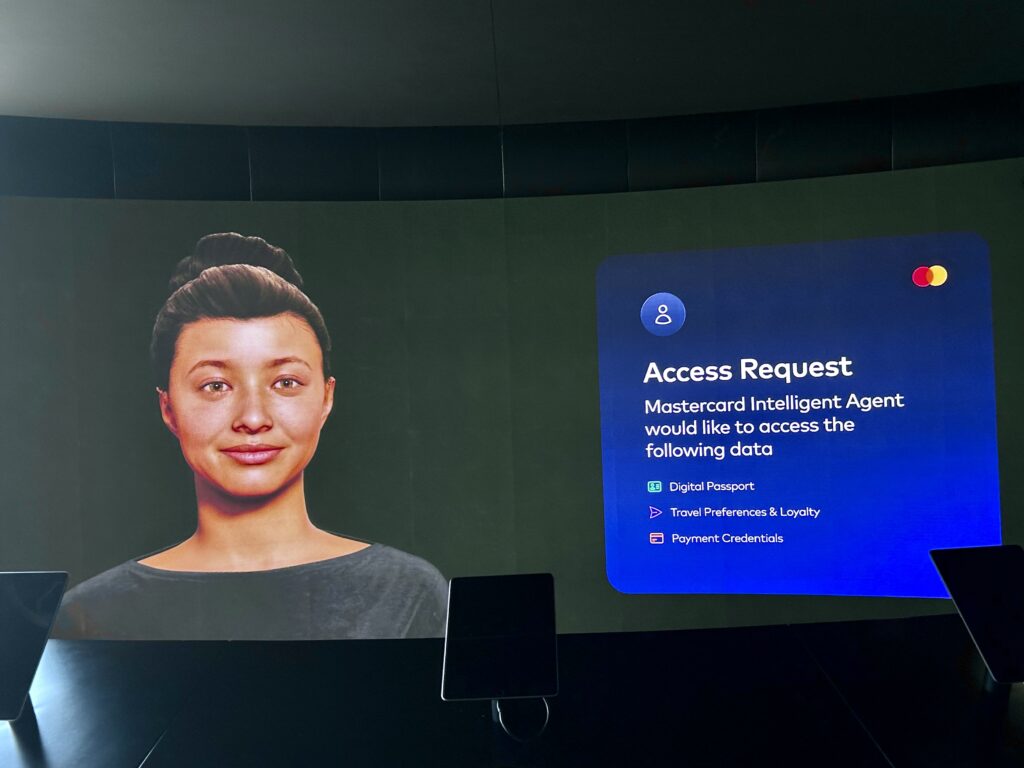

Expect more AI too. Beyond its crucial role in fraud protection and cyber, Mastercard showcased to us its ‘Intelligent Agent’ solution. Imagine an avatar with whom customers can interact via a conventional conversation. Said avatar could, for example, book flights and then potentially make a hotel reservation in the same city. It might also be able to secure a table at a top restaurant. With payment details and user preferences saved, and the system constantly learning (that you prefer, say, morning flights and aisle seats), in the words of our host, AI could “transform the payment landscape.”

3 July 2024

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Heptagon Capital is an investor in Mastercard Inc. The author of this piece has no personal direct investment in the business. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Click here to view all Blog posts.

Alex Gunz, Fund Manager

Photos by the author.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)