Season 4, Post 14: Tailwinds. Headwinds too.

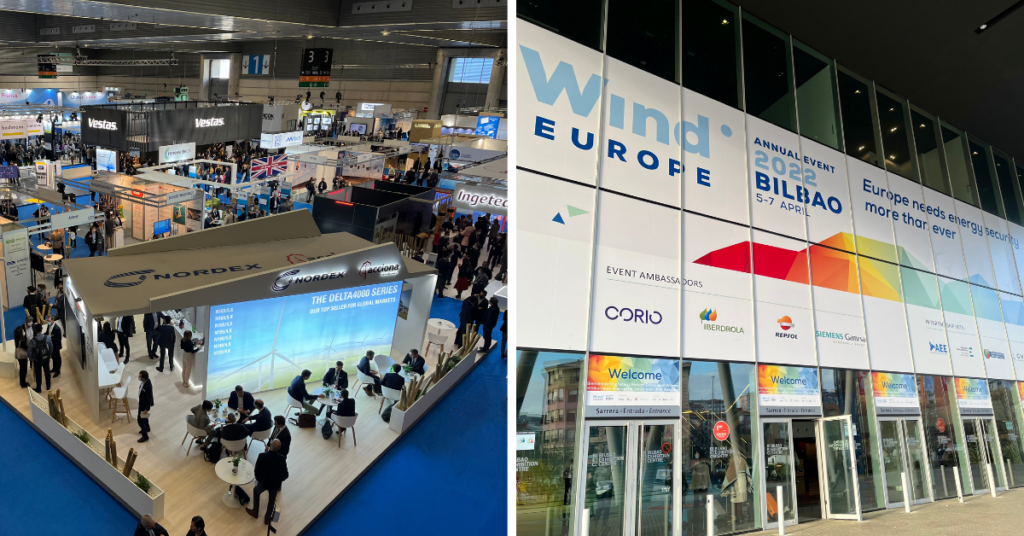

Your author is just back from Bilbao where he attended Wind Europe, one of the industry’s largest events. The case for wind as part of any country’s energy mix has been clear for some time, but the conference assumed heightened relevance given current geopolitical events. Read the posters welcoming visitors to the event and the message is unambiguous: “Europe needs energy security more than ever.” Such was the importance of Wind Europe this year that His Majesty, the King of Spain, opened the conference. For the c8000 visitors and 300+ companies present it was all about business (rather than the more fun elements often associated with such conferences) and a clear sense of urgency was palpable throughout the event.

The good news is that the desire and commitment to grow the wind sector is clear, both in Europe and elsewhere. The European Commission’s proposal would see the continent’s wind capacity grow 2.5 times between now and the end of the decade and by a factor of almost 7 over the next 30 years. As a result, companies across the value chain are pushing the boundaries of innovation. Vestas demonstrated at the conference its V172 turbine, apparently the world’s biggest, with 15% more megawatts of generating-capability relative to the previous model. Chinese manufacturers are also increasingly visible, and anecdotally, the list price of some turbines offered by these players is up to 50% below comparable levels offered by western manufacturers.

Demand is not the problem, however. The biggest headwind for the industry is supply. The debate has become less one about the case for wind and more one of how it gets fulfilled and the capacity installed. Data shared at the conference show that the Eurozone’s permitting backlog is currently four times the size of wind projects under construction, with Spain, Poland and Sweden having the most severe issues. Permitting is also a major issue in the US and, to an extent, in China. The time from permitting to a turbine coming online and generating power can be up to five years.

It is abundantly clear then that Europe needs to speed up its permitting if it wants to more rapidly expand the continent’s share of energy generated by renewables. Some even went further, with Eamon Ryan, Ireland’s Environment Minister, asserting that Europe needs a “defence procurement-style emergency process” for wind planning. The CEO of Siemens Gamesa (another major turbine player) highlighted how important it was for Europe to have a “robust and healthy” wind industry with “financial muscle.” Beyond permitting, other proposals we heard that would help ease headwinds include policies to upgrade grid infrastructure, a more holistic approach to auctions (where price was not the only issue determining winning bids, but also perhaps support for regional champions) and improved programmes for training specialised engineers. Even if the wind keeps blowing, none of this will happen overnight, however fervent the aspiration.

7 April 2022

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Heptagon Capital is an investor in Vestas. The author of this piece has no personal direct investment in the business. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Alex Gunz, Fund Manager

Photos taken by the author during his visit to the WindEurope Annual Event in 2022.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)