table of contents:

1. Summary

The Fund uses a growth style of investment in equity securities, whereby the Sub-Investment Manager seeks out investments with good growth potential. Under normal market conditions, the Fund will invest at least 80% of its net assets in the equity securities, including common and preferred stocks, of U.S. small/mid-capitalization (“small/mid-cap”) companies. The Sub-Investment Manager considers ESG factors to support the attractiveness of companies as long-term portfolio holdings for the Fund. The Sub-Investment Manager believes that the consideration of a broad array of factors, including ESG factors, is critical to generating risk-adjusted returns over time.

The Sub-Investment Manager promotes the E/S characteristics of the Fund through (1) embedding ESG scores into the investment research process (2) abiding to the exclusion criteria (3) through engagement (4) through proxy voting and (5) PAI consideration.

The sub-investment manager uses multiple reputable ESG data providers that embed materiality of ESG factors into their scores and ratings and uses these to get a holistic understanding of each company’s ESG performance from different perspectives.

The Fund does not have a sustainable investment objective and does not have a designated reference benchmark to measure the attainment of the ESG characteristics of the Fund.

2. No sustainable investment objective

The Fund promotes environmental and social characteristics but does not have sustainable investment as its objective.

3. Environmental or social characteristics of the financial product

The Sub-Investment Manager believes material ESG factors may affect the sustainability of companies’ future earnings and profitability and therefore may impact the risk and return potential of their long-term investment prospects. Therefore, the Sub-Investment manager takes ESG factors into consideration when evaluating potential securities to add to the portfolio.

The ESG factors which are deemed material may vary from sector to sector and from company to company. For clarity, whereas for one company, water usage may be considered a material factor for future earnings and profitability, and therefore the sub-investment manager may look to promote good water usage practices at such company through engagement or otherwise (see below the list of different ways the sub-investment manager promotes E/S characteristics), water usage may be immaterial to another company and therefore not be considered.

Environmental factors may include, among others:

- Carbon emissions

- Water scarcity

- Waste management

- Electronic waste.

Social factors may include, among others:

- Workplace safety

- Data protection and privacy

- Employee and management diversity

- Labor standards

- Employee training and development and;

- Customer satisfaction protection policies.

As each factor is company specific depending on the materiality to future earnings and profitability, the sub-investment manager uses multiple reputable ESG data providers that embed materiality of ESG factors into their scores and ratings and uses these to get a holistic understanding of each company’s ESG performance from different perspectives. These different providers and approaches provide the sub-investment manager with ESG scores, ESG risk exposure, ESG performance through media monitoring, controversy involvement and UN Global Compact compliance.

At the overall sub-fund level, the ESG characteristics promoted include:

- ESG disclosure through engagement and proxy voting

- Engaging with companies that have material ESG-related risks based on third party ESG

scores and/or qualitative data and seeking improvement in that data over time if Sub-

Investment Manager agrees with the scores and/or data. - Minimum environmental and social safeguards through embedding ESG scores and qualitative

data into the investment research process and applying the exclusion criteria - Adherence to the UN Global Compact by engaging with non-compliant companies or

companies on watchlist status - Understanding and identifying the environmental and social adverse impacts through PAI

consideration as detailed below.

The Sub-Investment Manager promotes the E/S characteristics of the Fund through (1) embedding ESG scores into the investment research process (2) abiding to the exclusion criteria (3) through engagement (4) through proxy voting and (5) PAI consideration.

For further information on proxy voting and engagement please refer to the sub-investment manager’s Responsible Investment and Proxy Voting policies available at: Driehaus Responsible Investment Policy Page Microsoft Word - DCM Summary of Proxy Voting Policy 2-2023 - FINAL[5].doc (driehaus.com)

4. Investment strategy

The Fund uses a growth style of investment in equity securities, whereby the Sub-Investment Manager seeks out investments with good growth potential. Under normal market conditions, the Fund will invest at least 80% of its net assets in the equity securities, including common and preferred stocks, of U.S. small-capitalization (“small-cap”) and U.S. medium-capitalization (“mid-cap”) companies (together, “Small/Mid cap” companies).The Sub-Investment Manager currently considers a company to be a small/mid cap company if it/they is/are within the same market capitalization range at the time of investment as those included in the Russell 2500® Growth Net Total Return Index (the “Benchmark”).

While the Fund will invest primarily in the equity securities of U.S. Small/Mid-cap companies, the Fund may also from time to time invest up to a maximum of 20% of its assets in the equity securities of non-U.S. companies that trade in the U.S. or in equity securities of companies with market capitalization above or below the range of those companies in the Benchmark.

The Sub-Investment Manager considers ESG factors to support the attractiveness of companies as long-term portfolio holdings for the Fund. The Sub-Investment Manager believes that the consideration of a broad array of factors, including ESG factors, is critical to generating risk-adjusted returns over time. Furthermore, in-line with the Sub-Investment Manager’s risk management process, the purpose of the aforementioned analysis is to ensure that ESG-related risks are identified, understood, and controlled, to the extent practical.

The Sub-Investment Manager excludes companies directly involved in the activities described in the binding criteria section. The Sub-Investment Manager also seeks to engage with investee companies through proxy voting and occasionally through direct communication with management and boards of directors.

Engagement efforts with companies serve as a tool to further evaluate and explore risks, including material ESG risks and to enhance due diligence. Much of the Sub-Investment Manager’s engagement efforts are generated on a case-by-case basis and centred around the most relevant or material risks for a given company.

5. Proportion of investments

The fund aims to achieve its objective by investing predominantly in a concentrated portfolio of equity securities, including common and preferred stocks of U.S. small/mid-cap companies. The Fund may also hold cash or cash equivalents, and the Fund may use derivative instruments for the purposes of efficient portfolio management and hedging under the conditions and within the limits laid down by the Central Bank.

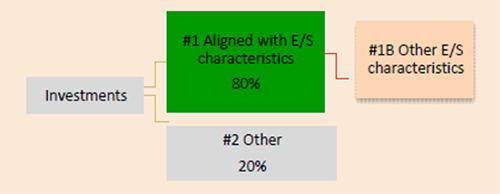

All Fund investments go through the same screening and investment process and are made with environmental and social considerations, which may vary from industry to industry and from company to company. Therefore, under normal circumstances, in order to meet the environmental or social characteristics promoted, the Fund is generally expected to invest at least 80% of its equity exposure

in companies aligned with the E/S characteristics of the Fund but that may not be classified as sustainable investments as defined under the SFDR. The remainder could be held in companies that may not match the Fund ́s ESG criteria in its entirety or in cash or cash equivalents, nevertheless, all investments excluding cash and equivalents go through the same screening process and are made with ESG considerations.

6. Monitoring of environmental or social characteristics

The Sub-Investment Manager promotes the E/S characteristics of the Fund through (1) embedding ESG scores into the investment research process (2) abiding to the exclusion criteria (3) through engagement (4) through proxy voting and (5) PAI consideration.

As mentioned, materiality of ESG factors vary from sector to sector and from company to company, therefore, as described above, the sub-investment manager uses ESG data providers that embed materiality of ESG factors into their scores, ratings and qualitative data amongst others to measure the attainment of the E/S characteristics. Therefore, the indicators the sub-investment manager looks at to measure the attainment at the sub-fund level include:

- ESG scores from third party vendors

- Number and % of companies that do not meet the ESG exclusion criteria of the Sub-fund

- Number and % of companies that are in violation of UN Global Compact Compliance

- Total number of companies engaged on ESG topics

- Total number of proxies voted

In addition to the above, the attainment of the environmental or social characteristics promoted will also be measured by the Sub-Investment Manager using the Principal Adverse Impact (“PAI”) regime. Please see the Sub-Investment Manager’s PAI Policy for more information.

7. Methodologies

When assessing these metrics, the Sub-Investment Manager considers the elements below to monitor how underlying companies meet the desired E/S characteristics:

- Level of company awareness on ESG principles - awareness as a first step towards improvement;

- Identification of what the Sub-Investment Manager believes to be salient sustainability issues, which results in engagement with company to foster good practices;

- Identification of areas of improvement; and

- Systematic monitoring of ESG ratings and controversies.

The aim is to identify ESG-related business practices that may impact a company’s future earnings-growth trajectory and risk/reward profile of an investment in the relevant company. The Sub-Investment Manager believes material ESG factors will affect the sustainability of companies’ future earnings and profitability and therefore, may impact the risk and return potential of our long-term investment prospects.

8. Data sources and processing

The sub-investment manager uses multiple reputable ESG data providers that embed materiality of ESG factors into their scores and ratings and uses these to get a holistic understanding of each company’s ESG performance from different perspectives. These different providers and approaches provide the sub-investment manager with ESG scores, ESG risk exposure, ESG performance through media monitoring, controversy involvement and UN Global Compact compliance.

As each factor is company specific depending on the materiality to future earnings and profitability, the sub-investment manager receives data inputs from multiple third party ESG data providers:

- MSCI Inc

- Sustainalytics

- TruValue Labs

These providers embed materiality of ESG factors into their scores and ratings and provide the sub-investment manager with ESG scores, risk exposure, and performance through media monitoring, controversy involvement, and UN Global Compact compliance. The sub-investment manager can then use this information to get a holistic understanding of each company’s ESG performance.

9. Limitations to methodologies and data

Limitations on methodologies and ESG data include the lack of consistency, reliability, comparability, and quality of the data available. This is driven by issues including, but not limited to:

- Lack of common methodology across providers of ESG ratings;

- Lack of ESG resources in Small Cap companies compared to Large Cap;

- Lack of standardised reporting by companies;

- Lack of timely updated data across providers of ESG ratings;

- Different estimation models for unreported data;

- Difficult to quantify factors and unverified or unaudited information; and

- Backward looking information that fails to capture “direction of travel”.

We attempt to address these limitations by:

- Use of varied data sources;

- Company engagement to understand data at source; and

- Complimenting third party ESG data with internal research and analysis..

10. Due diligence

The Sub-Investment Manager assesses sustainability risks at the pre-investment stage and on an ongoing basis as follows:

Pre-investment - due diligence assessment

The Sub-Investment Manager seeks to identify and understand risks associated with investing in companies with high probability of sustainability risks that the Sub-Investment manager believes have a likelihood of impacting future returns. The Sub-Investment Manager seeks to identify risks early in the analytical process. As a result of the pre-investment due diligence assessment, together with adherence to exclusion criteria and selection process described, the Sub-Investment Manager believes that the potential negative impacts of sustainability risks on returns are reduced.

Ongoing assessment

Where there is a marked deterioration observed in a company’s material sustainability-related risks, the Sub-Investment Manager will seek to engage with the business‘ management where possible, and although the Sub-Investment Manager typically does not escalate matters if an engagement is unsuccessful, if the Sub-Investment Manager`s investment team is uncomfortable with the risks, its general approach is to divest the investment.

11. Engagement policies

For further information on proxy voting and engagement please refer to the sub-investment manager’s Responsible Investment and Proxy Voting policies available at: Driehaus Responsible Investment Policy Page Microsoft Word - DCM Summary of Proxy Voting Policy 2-2023 - FINAL[5].doc (driehaus.com).

12. Designated reference benchmark

The Fund does not have a sustainable designated reference benchmark.