Post #90: Your author goes back to school

Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation.

Education has never been more important. With the near-term outlook for employment highly uncertain, being able to differentiate through better educational attainment matters. Demand for additional EdTech services has therefore taken off in 2020. But just how good are they? Your author is perhaps not the most obvious target-market candidate being in his mid-40s and having kids still at primary school. Nonetheless, in the spirit of endeavour and research – and attracted by the easy cancellation policy – I recently signed up to a month of Chegg Study. Here’s what I learned -

Chegg is a leading direct-to-student learning platform, which has grown primarily through word of mouth. Its platform receives ~15m unique visitors in an average month, attracted presumably by “step-by-step textbook solutions for 9,000 books”, the ability to “ask questions of experts and enthusiasts 24/7” as well as to “search millions of homework answers.” For $14.95/month, this seems almost too good to be true.

The first nasty surprise, however, is that after seeing the above headline price advertised on the Chegg landing page, new users are pushed towards Chegg’s “most popular” option, its Study Pack, priced at $19.95. Admittedly, five more offers are included in this package, including guided videos and an interactive writing tool. If nothing else, it is a great example of upselling, but being a generous sort, I opted for the premium package.

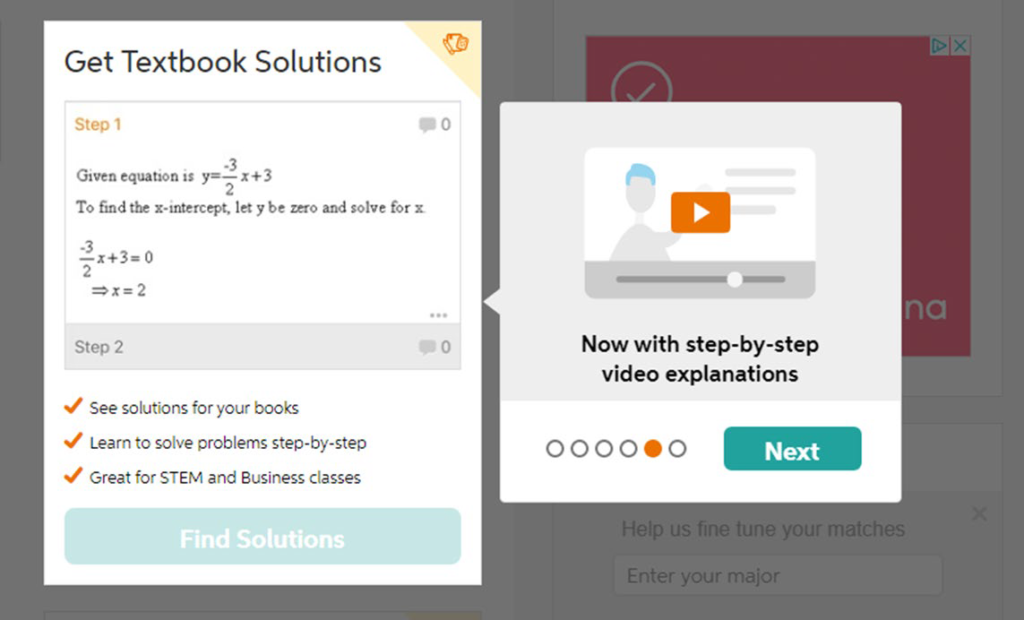

Once signed in, the range of options available for the student is almost bewildering – in a good way. Want to be linked up to a tutor within five minutes for some dedicated revision, or perhaps test your knowledge with some flashcard questions or a multiple-choice exam? It’s all possible. Similarly, Chegg can help solve tricky maths equations, check essay papers for plagiarism – this piece contains none - or pose questions that are not in its database to remote experts, who promise speedy answers. Subjects from chemistry to computer science are covered.

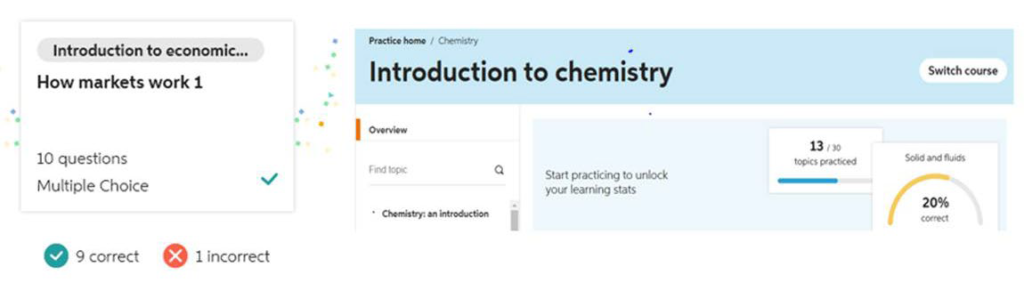

In my road-testing, the Chegg system did not seem flummoxed by any of the questions put to it, providing comprehensive answers to everything from what constitutes a Giffin good to what is it like to be a bat (goods people consume more of as the price increases, and a philosophical consideration of the uniqueness of experience, respectively). Sitting a couple of test exams did bring back less than fond memories of school days, and while it was reassuring to see that my knowledge of “how markets work” (a basic economic paper) was still intact, the same could not be said of my skills in chemistry. Fortunately, the latter is not so necessary in this job.

The user interface is highly intuitive (even for a non-student such as your author), while the ability to see your learning stats for any given period is a nifty innovation – and presumably a good incentive to keep on using the service too. While it would be hard to know how well the Chegg platform compares with others, the tools available have the clear potential to help improve learning outcomes. The direction of travel for the EdTech sector is clear: less than 3% of total global education spend is currently allocated to online resources (per Barclays Investment Research), but the sector could be worth at least $300bn by 2025.

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)