table of contents:

1. Summary

The Fund’s Sub-Investment Manager, Yacktman Asset Management LP (“Yacktman”), was established in 1992 and operates out of Austin, Texas.

The Fund uses a rigorous and disciplined bottom-up approach with value-oriented stock selection. A forward rate of return valuation method is used to analyse potential Fund holdings. The Fund aims to achieve long-term capital growth by investing predominately in a diversified portfolio of US equities. The Sub-Investment Manager believes that the consideration of a broad array of factors, including ESG factors, is critical to generating risk-adjusted returns over time. As such, consideration of financially material ESG factors supports the attractiveness of companies as long-term portfolio holdings for the Fund.

The Sub-Investment Manager promotes the E/S characteristics of the Fund through (1) embedding analysis of financially material ESG factors into the investment research process (2) abiding by the exclusion criteria and (3) through engagement and proxy voting.

The Fund does not have a sustainable investment objective and does not have a designated reference benchmark to measure the attainment of the ESG characteristics of the Fund.

2. No sustainable investment objective

The Fund promotes environmental and social characteristics but does not have sustainable investment as its objective.

3. Environmental or social characteristics of the financial product

The investment objective of the Fund is to achieve long-term capital growth. In working toward this objective, the Sub-Investment Manager believes that financially material and relevant ESG factors may affect the sustainability of companies’ future earnings and profitability. As such, ESG factors, when relevant and financially material, are some of a broad array of factors considered during the assessment of risk-adjusted forward rates of return and long-term investment prospects of a business.

The ESG factors which are deemed financially material may vary from sector to sector and from company to company. As an example, for one particular sector, product safety may be considered a material and relevant factor when assessing future earnings and profitability of a company, and therefore, the Sub-Investment Manager may place significant weight on the strength of product safety practices at a company in this sector when performing its assessment. Product safety may, however, be irrelevant and financially immaterial in another sector and, therefore, may not be considered during the investment analysis of a company in this sector.

Environmental characteristics:

Where deemed financially material to the forward rate of return of a business, the Sub-Investment Manager may consider a range of environmental characteristics, including:

- Overall strong environmental practices regarding areas such as water usage, pollution, and waste management;

- Greenhouse gas (“GHG”) emissions disclosure; and

- Lack of or well-managed environmental controversies.

Social characteristics:

Where deemed financially material to the forward rate of return of a business, the Sub-Investment Manager may consider a range of social characteristics, including:

- Human rights considerations;

- Efficient and effective supply chain management;

- Product safety standards; and

- Lack of or well-managed social controversies.

Additionally, strong corporate governance is a fundamental and ongoing consideration within the Sub-Investment Manager’s investment process, as the Sub-Investment Manager believes companies with strong management and a receptiveness to constructive engagement are well-positioned to monitor, manage, and improve upon their response to environmental and social risks that are relevant to their businesses now and in the future. In pursuing this investment process, the Sub-investment Manager’s additional ESG considerations may include but are not limited to:

- ESG reporting, disclosures, and transparency; and

- Potential for positive rate of change in ESG practices (i.e., a company has improved/looks to be improving its’ ESG practices, as measured by the Sub-Investment Manager).

In summary, the Sub-Investment Manager believes that the consideration of a broad array of risk factors, including ESG factors where financially material, is critical to generating strong risk-adjusted returns over time.

4. Investment strategy

The investment objective of the Fund is to achieve long-term capital growth. This objective is achieved through the generation of strong risk-adjusted returns over a full market cycle. To that end, the Sub-Investment Manager will invest mainly in common stocks of U.S. companies, with select exceptions if and where deemed suitable. The Sub-Investment Manager employs a disciplined investment strategy that can invest in companies of any size at what the Sub-Investment Manager determines are attractive prices for such.

The Sub-Investment Manager does not manage to a benchmark and invests without specific regard to the market capitalisations or sectors of such issuers; accordingly, the Fund may exhibit considerable differentiation from peers and market indices in that regard. However, the Sub-Investment Manager will typically prefer larger companies to smaller companies and the Fund will not concentrate 25% or more of its total assets in securities of any one industry. This limitation does not apply to obligations (such as bonds, preferential shares, and convertible securities) issued or guaranteed by the U.S. Government, or its agencies or instrumentalities. The Fund will sell or trim its investments in companies that no longer meet the Sub-Investment Manager’s investment criteria, or if better investment opportunities are available.

The Sub-Investment Manager considers ESG-related factors, where relevant and financially material, as part of its assessment of the risks to a business and its effort to identify business that will generate strong risk-adjusted forward rates of return. The Sub-Investment Manager believes that the consideration of a broad array of factors, which would include ESG factors where relevant and material, is critical to generating strong risk-adjusted returns over time. Strong corporate governance is a fundamental pillar of the investment process, as the Sub-Investment Manager believes companies with strong management are well-positioned to monitor and manage environmental and social risks that are relevant to their business. The Sub-Investment Manager excludes companies directly involved in the activities described in the binding criteria section and seeks to invest in companies that, amongst other criteria, meet the ESG practices described.

The Sub-Investment Manager also seeks to engage with investee companies through proxy voting and, occasionally, through direct communication with management and boards of directors on issues deemed material to the business.

5. Proportion of investments

The Fund will mainly invest in common stocks of U.S. companies, some, but not all of which, pay dividends. The Sub-Investment Manager will employ a disciplined investment strategy by investing in companies of any size at what they determine are attractive prices for such. The Fund may also hold cash or cash equivalents, and the Fund may use derivative instruments for the purposes of efficient portfolio management and hedging under the conditions and within the limits laid down by the Central Bank.

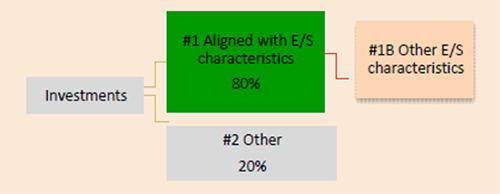

All Fund investments go through the same screening and investment process and are made with environmental and social considerations, which may vary from industry to industry and from company to company. Therefore, under normal circumstances, in order to meet the environmental or social characteristics promoted, the Fund is generally expected to invest at least 80% of its equity exposure in companies aligned with the E/S characteristics of the Fund but that may not be classified as sustainable investments as defined under the SFDR. The remainder could be held in companies that may not match the Fund´s ESG criteria in its entirety or in cash or cash equivalents, nevertheless, all investments excluding cash and equivalents go through the same screening process and are made with ESG considerations.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

The category #1 Aligned with E/S characteristics covers:

- The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

- The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

6. Monitoring of environmental or social characteristics

The materiality of environmental and social indicators which are analysed to measure the attainment of the environmental and social characteristics may vary considerably from industry to industry and from company to company and, in addition, may be dependent on data availability. For example, for some companies, toxic waste may be a material risk to the business if poorly managed, whereas this same issue is immaterial to other companies.

While areas below are not necessarily financially material to all firms or sectors, examples of environmental and social indicators may include, but are not limited to:

Environment

- Disclosing GHG emissions;

- Overall strong environmental practices regarding areas such as water usage, pollution, and waste management;

- Compliance with the United Nations Global Compact’s Environment Principles, specifically:

- Principle 7: Businesses should support a precautionary approach to environmental challenges;

- Principle 8: undertake initiatives to promote greater environmental responsibility;

- Principle 9: encourage the development and diffusion of environmentally friendly technologies; and

- Lack of or well-managed environmental controversies

Social

- Compliance with the United Nations Global Compact’s Human Rights Principles, specifically

- Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights; and

- Principle 2: make sure that they are not complicit in human rights abuses;

- Compliance with the United Nations Global Compact Labour Principles, specifically:

- Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

- Principle 4: the elimination of all forms of forced and compulsory labour;

- Principle 5: the effective abolition of child labour; and

- Principle 6: the elimination of discrimination in respect of employment and occupation;

- Product safety; and

- Lack of or well-managed social controversies.

When assessing these indicators, the Sub-Investment Manager may also consider areas including:

- Corporate governance indicators (described in the following sections);

- Benefits to society and/or the global economy of a given firm or sector;

- A positive rate of change on topics deemed material; and

- Identification of areas of potential improvement that leads to proxy voting/engagement with companies on material matters.

The Sub-Investment Manager believes that there is considerable nuance in weighing investment indicators (ESG-related indicators or otherwise), and that context is important to consider when analysing a business.

7. Methodologies

When assessing these metrics, the Sub-Investment Manager considers the elements below to monitor how underlying companies perform against financially material E/S characteristics:

- Company awareness of ESG performance - awareness as a first step towards improvement;

- Identification of what the Sub-Investment Manager believes to be salient sustainability issues, which results in analysis and/or engagement with company to foster good practices;

- Identification of areas of improvement; and

- Systematic monitoring of ESG ratings and controversies.

The aim is to identify financially material ESG metrics that may impact a company’s future earnings-growth trajectory. The Sub-Investment Manager believes financially material ESG factors will affect the sustainability of companies’ forward rate of return and therefore may impact the long-term investment prospects potential.

8. Data sources and processing

The data sources used to analyse the financially material environmental and social characteristics of the fund may include:

- Bloomberg data;

- Company reports;

- Monitoring of articles and news;

- ISS data;

- Matter data (third-party ESG data provider).

These data sources allow the Sub-Investment Manager to understand the ESG performance of each holding, explore and analyse the sustainability profile of individual issuers and monitor compliance with policies and investment approach. Each factor is company and sector specific which also determines its financial materiality to future earnings and profitability.

9. Limitations to methodologies and data

Limitations on methodologies and ESG data include the lack of consistency, reliability, comparability, and quality of the data available. This is driven by issues including, but not limited to:

- Lack of common methodology across providers of ESG ratings;

- Lack of standardised reporting by companies;

- Lack of timely updated data across providers of ESG ratings;

- Different estimation models for unreported data;

- Difficult to quantify factors and unverified or unaudited information; and

- Backward looking information that fails to capture “direction of travel”.

We attempt to address these limitations by:

- Use of varied data sources;

- Company engagement to understand data at source; and

- Complimenting third party ESG data with internal research and analysis.

10. Due diligence

The Sub-Investment Manager assesses sustainability risks at the pre-investment stage and on an ongoing basis as follows:

Pre-investment - due diligence assessment

Any business identified as having a high probability of a financially material sustainability risk that could impact forward rate of return and profitability would not be included in the final portfolio. As a result of the pre-investment due diligence assessment, together with adherence to exclusion criteria and selection process described, the Sub-Investment Manager believes that the potential negative impacts of sustainability risks on returns are reduced.

Ongoing assessment

Where there is a marked deterioration observed in a company’s financially material sustainability-related risks, the Sub-Investment Manager will seek to engage with the business’s management where possible. The Sub-Investment Manager typically selects stocks with the purpose of holding it for an extended period of time, however if the Sub-Investment Manager`s investment team is uncomfortable with the financially material risks, its general approach is to divest the investment.

11. Engagement policies

For further information on proxy voting and engagement please refer to the Sub-Investment Manager’s Voting policies available at [website address will be updated once website disclosures go live].

12. Designated reference benchmark

The Fund does not have a sustainable designated reference benchmark.