We're all hungry for some agtech

Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation.

Executive summary: At least $10bn of funding has flowed into the agtech industry in the last 5 years, with this figure set to grow meaningfully going forward. The prize is significant: the agrifood industry is worth $7.8trillion and ripe for disruption. Technological advancements can help solve the conundrum of shrinking food supply combined with growing demand needs. As a result, innovation is occurring in areas as diverse as farm robotics and automation, novel farming systems (indoor farms), innovative food (cultured meat) and supply-chain improvements. Many innovators are still privately owned but established listed incumbents have increased both internal investment and acquisition activity. Expect more. Our strategy is to favour leaders in niche segments.

Agriculture has to be one of the world’s oldest industries. There are records of people gathering wild grains over 105,000 years ago. Meanwhile pigs, sheep and cattle were first domesticated some 10,000 years ago. Farmers, therefore, have always had to be innovative in terms of battling nature in order to feed both themselves and their families. The industry has also been no stranger to technological change, particularly with the Industrial Revolution replacing handheld practices with mechanised ones.

Nonetheless, when the agrifood industry (best thought of as encompassing everything from farm to fork) is compared to many others, it is still highly inefficient. Production systems, yields and outputs may have improved markedly but, at the same time, have brought about a series of notable adverse side-effects including ecological and environmental damage not to mention wasted food. Against this background, the industry is ripe for disruption. The good news is that entrepreneurs and technologists are increasingly exploring ways of creating new efficiencies across the whole supply chain. The emerging agtech industry can be best thought of as a range of technologies used to run the agricultural space, from apps to robots and from enhanced seeds to innovative foods.

The flurry of interest in the field is being driven by two factors: inexorable secular trends combined with technological advancements. Take the former and consider that the global population is predicted to peak at almost 10bn by 2050 at a time when climate change and environmental pollution are causing land degradation and limiting access to water. The implication is that by the middle of this century, an extra 220,000 people will require feeding every day. Put another way, farmers will have to sustainably generate around 50% more yield from the land they have available in order to feed the world’s population (all data per the United Nations).

Land is precious. Only 3% of the earth’s surface is arable land available for farming. Yet global farmland is shrinking on an absolute basis for the first time ever, with over 30% of the planet’s soil now actively degraded. Moreover, raising animals for human consumption requires vast amounts of land, water and feed. To make one quarter-pounder hamburger requires 6 kilograms of feed, 1,700 litres of water and 6 square metres of land (data per 13D Research). Growing demand for protein – especially in emerging markets – also implies that global meat consumption is expected to increase by 75% over the 35-year period from 2015-2050 (per the United Nations). Climate change is exacerbating not only land shortages but also changing oceanic conditions, implying that outdoor environments will become less reliable and more intolerant both for crops and fish.

Technological advancements may provide a solution to the food conundrum of shrinking supply and growing demand. The rationale for agtech initiatives is to drive agronomic productivity and efficiency; put simply, generating more yield per input by using data-driven insights and the right equipment/systems. A combination of rural broadband, cloud-computing, the internet of things and big data analysis (all of which we have discussed in previous Future Trends notes) is ushering in the large-scale application of IT in the farming sector. No formal category definitions exist for what may be considered part of the agtech revolution, but we would highlight all the following as being relevant –

• Farm robotics, mechanisation and equipment, which includes on-farm machinery, automation, drone manufacturers and growing equipment.

• Farm management and software: sensing and the internet of things via data-capturing devices, decision support software and big data analytics.

• Ag-biotechnology, comprising on-farm inputs for crops and animals including genetics, microbiome, breeding and animal health.

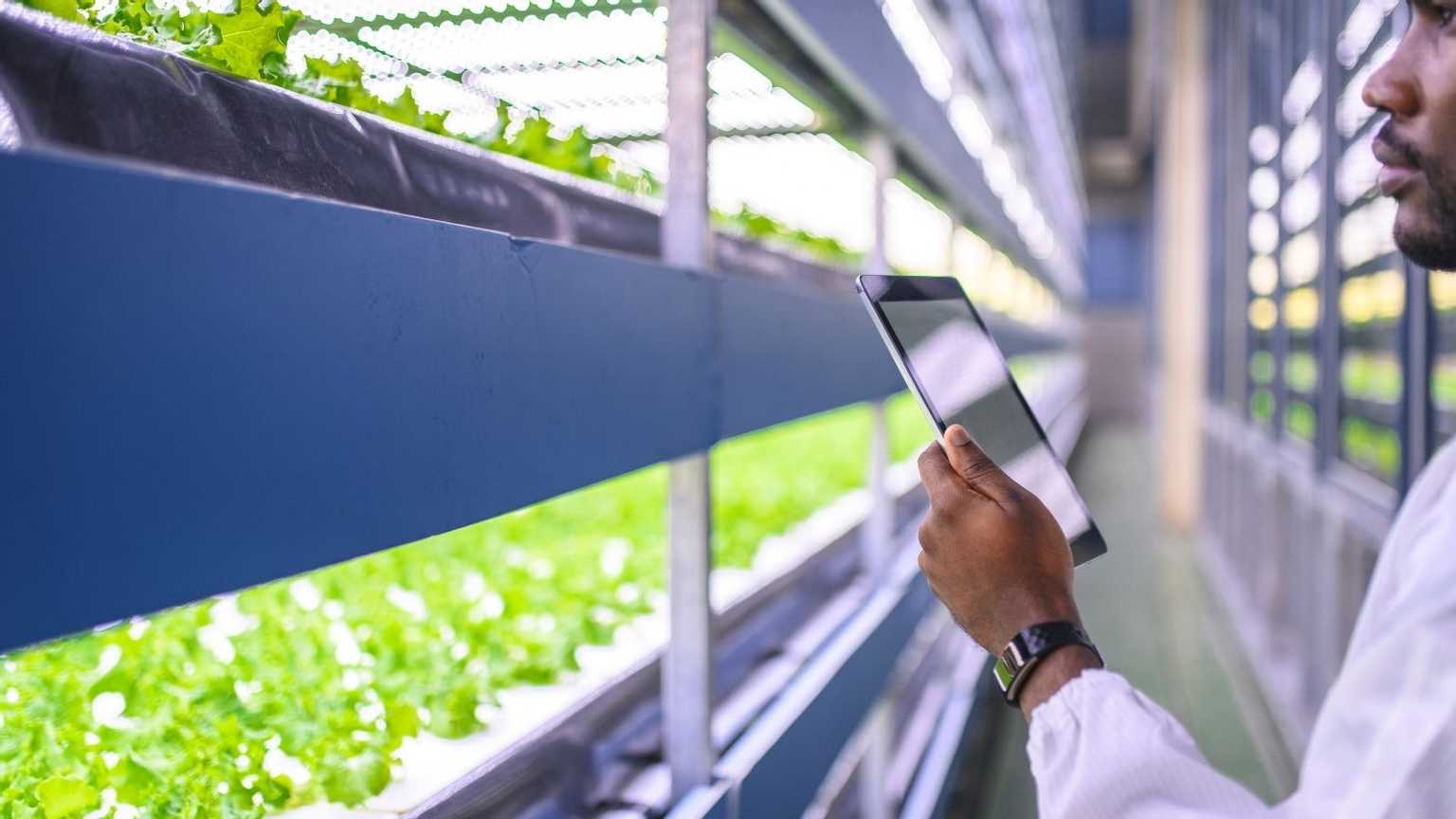

• Novel farming systems such as indoor farms and aquaculture.

• Innovative food comprising cultured meat, novel ingredients and plant-based proteins.

• Supply-chain technologies including food safety traceability technology, better logistics and transport.

The first two of these areas can be thought of as the relatively most mature. Yield monitoring software is used by some 48% of farms covering 70% of potential acres in the US, while 29% of American farms (or 54% of available acres) deploy guidance systems for their farming equipment (per the US Department of Agriculture). Impressive as these figures may seem, there is still much to be done and adoption levels are likely to be markedly lower elsewhere in the world, particularly in emerging economies. Technology is now being applied to a variety of use cases from the analysis of satellite images and in-field monitoring to assess crop and soil health, to the next iteration – predictive analysis. Robotic and artificial intelligence systems have the potential to enable farmers to improve crop cultivation and reduce chemical application by identifying diseases at an early stage and optimising planting times. Leading players within this field include Blue River Technology (now owned by Deere) and ecoRobotix (a private Swiss business).

Looking beyond conventional farming, part of the broader agricultural revolution is the growing theme of moving food production from rural to urban areas. Indoor urban farms can help reduce food transportation costs, increase yields and allow for year-round production of certain crops. Automated vertical farms can grow crops at twice the speed of conventional farms while using 40% less power, creating 80% less food waste and using 99% less water than outdoor fields (per Futurism, a consultancy). Ventures have sprung up around the world including in Japan, Singapore and the US. AeroFarms in New Jersey has been operating since 2004 and claims to be the world’s largest vertical farm, a 70,000 square foot compound producing 2m pounds of food annually. Aero says its yields are over 300 times those of conventional farms.

Consumers, however, don’t just want fresher food, but also healthier and more sustainable food. Some 36% of US consumers, for example, say they want to reduce their meat consumption (per Kantar TNS). As a result, an industry for meat- and fish-based alternatives is emerging. Plant-based proteins have been produced for many years, but are now being done at increasing scale. In addition, many businesses are experimenting with lab-grown meat/fish as a substitute for the farmed/fished equivalent. Memphis Meats produced a meatball alternative in 2016 and has since been followed by Seattle Food Technology (chicken substitutes) and Finless Foods (tuna today; bass, carp and anchovy soon). As a result, the meat-alternatives market is currently worth $1.4bn and is growing at 22% annually (per Euromonitor).

Thinking bigger, the prize is much larger. At a high-level, the agrifood sector is a $7.8trillion industry, responsible for feeding the planet and employing over 40% of the global population (per AgFunder, a venture capital firm). The crop science market alone is worth $90bn (per Bayer) and the herbicide market is worth $26bn (per Phillips McDougall). Defining the size of the agtech market specifically is much harder although consultants Markets and Markets size the industry at $7.5bn today, growing to $15.3bn by 2023, equivalent to a 12% compound annual growth rate. Money is clearly flowing into the industry too. In the five years to 2017, annual global investment in food technology has increased by a factor of more than three to $10bn (per AgFunder).

Nonetheless, succeeding in the agrifood industry is not without challenges. The overall industry involves many established incumbents with complicated supply chains and vested interests. Farmers may hence be reluctant to embrace change. Consider also the inverted demographic pyramid of the American farmer (a model which broadly holds for much of the developed world): 62% are aged over 55 and 33% over 65 (per AgFunder) and so have retirement on the horizon and potentially different appetites to risk. Many newer technologies are still nascent and not fully proven. Robotic fruit pickers, for example, continue to struggle given that many products are not uniform in either shape or ripeness. Beyond farming, technologies are also immature and evolving. It may be one thing to replicate, say, a chicken cell in a test tube, but it is quite another to grow that by the millions and connect micro-thin cell layers to cells grown to mimic muscle, cartilage etc. Whether all consumers will have either the ability or desire to pay for lab-grown meat alternatives remains unclear.

For investors, the key challenge is, given the size of the addressable agrifood opportunity, how best to play it; or, in which part of the market to invest. Self-evidently, the market is highly diversified with almost no public pure-play businesses. Bayer, for example, acquired Monsanto (seed technologies) last year and owns FieldView (the world’s market leader in farm monitoring software), yet crop science and animal health account for less than one-third of its group revenues, the remainder coming from healthcare. Most listed companies only address one part of the value chain (e.g. crop protection or meat alternatives) and yet all say they are working on ‘digital initiatives’ to improve their processes. It is clear that incumbents need to disrupt from within, hence a number of recent large deals (Bayer-Monsanto, ChemChina-Syngenta, Dow-DuPont, Potash-Agrium) as well as smaller scale M&A (Deere buying Blue River Technologies, Tyson Foods investing in Beyond Meat, DowDuPont acquiring Granular – a farm management software platform – and so on).

Our preferred approach is to consider either industry leaders with clear and differentiated approaches (for example, Marine Harvest and its strategy for sustainable salmon farming, or Kerry Group and food innovation) or technology plays which offer some exposure to farming (such as Zebra Technologies via supply-chain tracking, FANUC via crop-processing robots or Trimble via its GPS equipment). One thing, however, looks clear: the agtech revolution is coming.

Alexander Gunz, Fund Manager, Heptagon Capital

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)

.jpg)