Season 3, Post 44: Riding the NFT wave

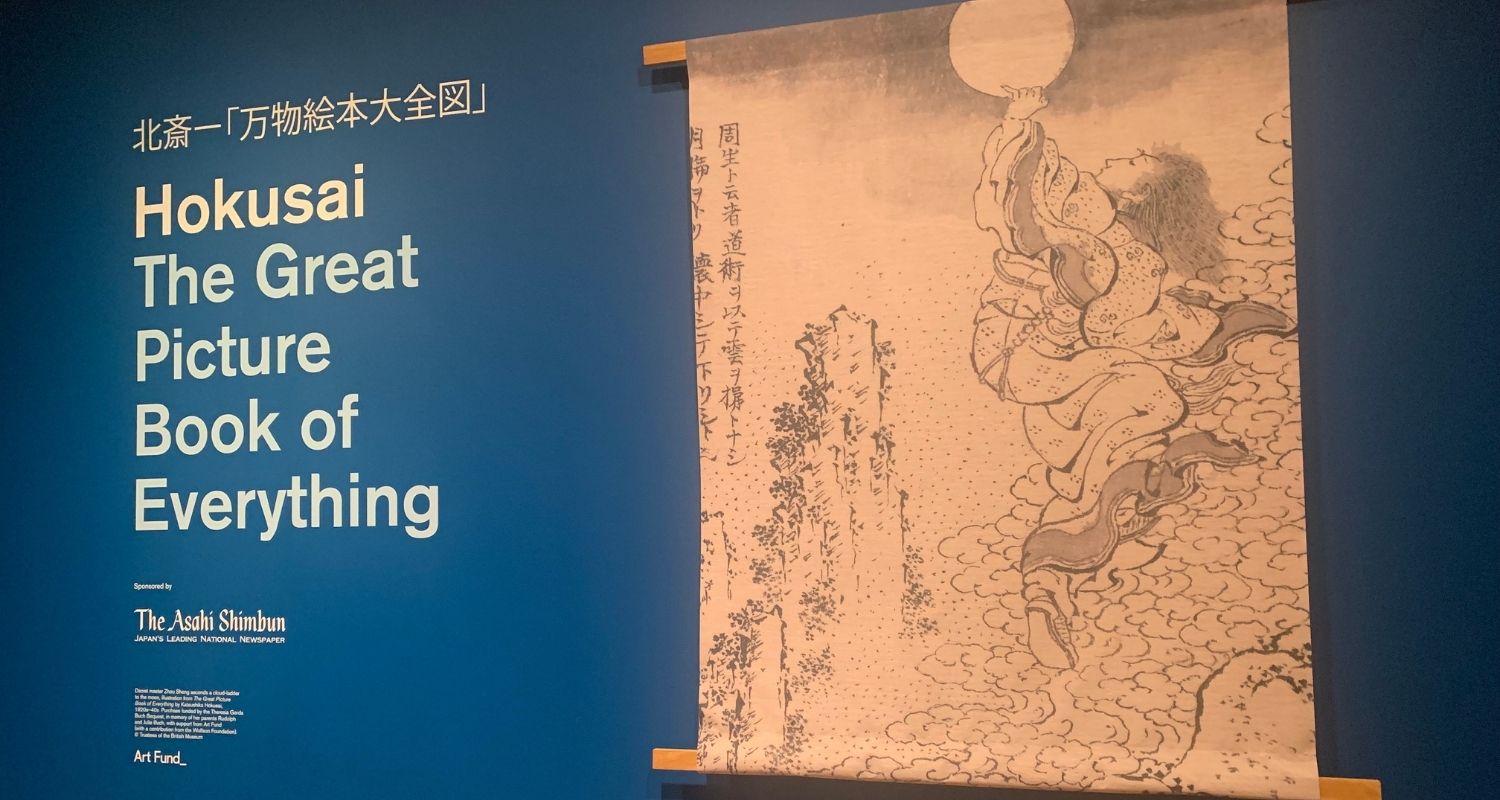

Ask most people about Japanese art and their first answer would likely be Hokusai, a prolific early 19th Century painter, most famous for the “The Great Wave”. If you’re lucky enough to live in London, then visit – as your author did recently – the British Museum (BM) for an exhibition of some of Hokusai’s rare drawings, on display there until the end of January. Observant visitors, however, will also note that it is possible to purchase a Hokusai. In a first for a major museum anywhere in the world, the BM has partnered with French start-up LaCollection to offer non-fungible tokens (NFTs) for Hokusai’s art. In the interest of future trends research (and a love of art), your author had the fortunate opportunity to catch up with Jean-Sébastien Beaucamps, the founder of LaCollection to learn more.

LaCollection arose out of lockdown. Many people – including Jean-Sébastien (and not to mention your author) – were missing the opportunity to visit art galleries and museums. These organisations were also struggling financially. Et voila… LaCollection was formed. The notion behind the business is very simple: LaCollection offers people the opportunity to build digital collections of art and simultaneously is able to provide a novel funding source for museums.

For those unaware, NFTs can be thought of as synonymous with digital assets. Just like each banknote is a unique fungible token, so each NFT is also unique, differentiated by a watermark (or digital lithography, as the founder of LaCollection calls it). The beauty of owning a NFT of, say, a Hokusai print is that it can be viewed in your house (via a lightbox, transparent screen or similar) as easily as it could be held in a personal collection (similar to if one were collecting stamps) or traded (given each is unique, and a record of it stored on an immutable blockchain). Our sense is that the BM was perhaps earlier to the game than any other major cultural institutions. Based on the success of its venture with LaCollection, more museums and galleries are likely to follow suit soon.

This is just the tip of the iceberg for the potential embedded in NFTs. “People are afraid of what they don’t understand,” per Jean-Sébastien, but perceptions are changing quickly, enabled by high-profile initiatives such as the one pioneered by the BM. At a basic level, many humans have a pathological need to collect, in our view, but the ease of transacting with NFTs and the security which underpins them is helping to break down resistance barriers. Over time, we expect NFTs to be increasingly leveraged for many other transactions, not just digital art. The media and sports industries would seem obvious next candidates, but as Jean-Sébastien puts it, there is “no doubt” that the wave ahead will “touch all industries.” Hokusai – a pioneer in his own era – would have been proud.

17 November 2021

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. The author of this piece has no personal direct investment in the business. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Alex Gunz, Fund Manager

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)