Season 3, Post 1: The weird and wonderful

Welcome to 2021. Sign of the times perhaps, but the title for our opening Blog post of the year perhaps captures both our current and future assessment of the world. Uncertainty reigns as the pandemic rages, but this won’t stop dynamic innovation occurring across all industries. With the present so murky, what could be more compelling than thinking about the future? We are innovating (albeit only very marginally) too. Having completed 100 Blog posts at the end of last year, we are opting for a ‘light’ rebrand; this is post one from our third season (or year) of Blog authorship.

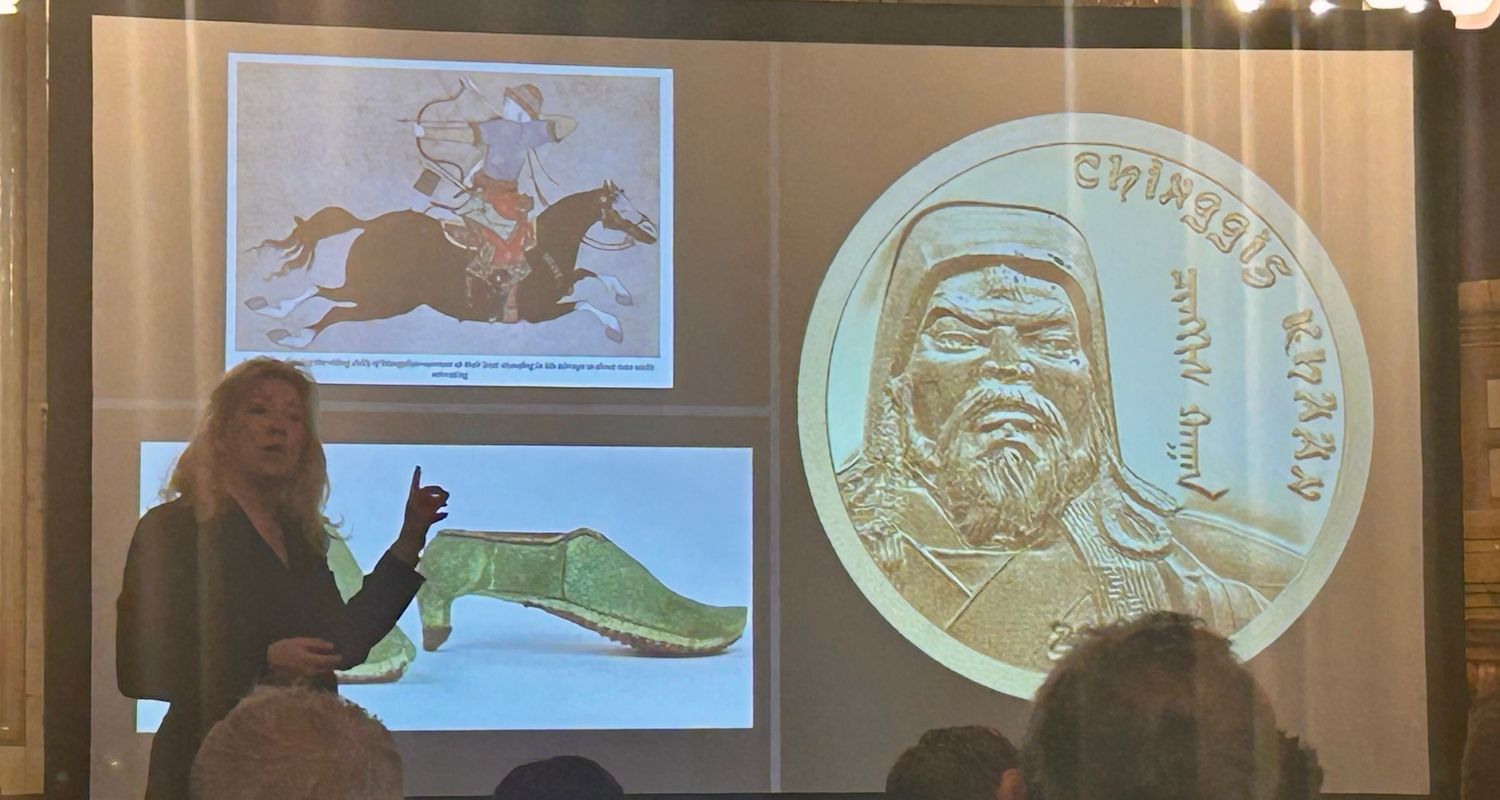

Back to the title of our Blog and where better to see both the weird and wonderful on show than at CES? For those unfamiliar, CES (or the Consumer Electronics Show) is the world’s largest trade show in this sphere, and it begins next week. It’s been running since 1967 and we last attended in 2017. This year’s show will, of course, be virtual but it won’t stop a swathe of announcements coming from corporates both large and small. Theme wise, we are watching for two new trends in particular. First, an adaptation to the ‘new normal.’ Put practically, this might mean new TVs with in-built Zoom functionality, or phone chargers which self-disinfect. Second, 2021 ‘may’ be the year of more augmented and/or virtual reality. Some of this could be wishful thinking – an escape from today’s real world – but expect the likes of more smart glasses, smart shoes and headsets with additional functionality.

Fast-forward to July and we may – all other things being equal – get a second dose of the weird and wonderful when the 32nd Summer Olympics hopefully commences in Tokyo, a year later than scheduled. Host nations generally use such events to showcase their prowess and domestic differentiation to the external world. Japan has had a long-held reputation for all things technological, so expect more robots, less cash and enhanced facial recognition. The former may act as de facto venue guides (and also help with social distancing). Stadia entry may also be increasingly done in the absence of personnel as facial recognition technologies improve. Meanwhile, the Olympics should act as a catalyst to accelerate digital payment adoption in Japan, which remains among the lowest in the world (cash has always culturally been favoured).

So, there is much about which to be potentially excited. However, it will remain crucial to separate hype from reality. This matters when considering future trends in general. All that glistens does not become gold (or a gold medal for that matter). Wishing readers all the best for the year ahead.

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Alex Gunz, Fund Manager

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.jpg)