Humanoid Robots: the real robot revolution

Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation.

Executive summary: Take robots and add artificial intelligence. The result: a new generation of humanoid robots with radically improved capabilities relative to more traditional robotic models. We will increasingly need such humanoids to support both an ageing population and a shrinking workforce. Already, humanoids can be found working in car factories and warehouses. As underlying technologies only improve and costs correspondingly fall, their number and the use cases in which humanoids can be deployed will only grow. By 2035, the market for humanoid robots could be more than 20 times its current size, equivalent to almost $40bn in value. Progress, of course, will be non-linear and today’s leaders may not end up being tomorrow’s winners. Regardless, more than $10bn of venture capital has flowed into humanoid robot start-ups in the last year. Large tech businesses and existing robotic players are also keen to get in on the act. Expect a swathe of product launches in 2025.

The robots are coming is a refrain we have heard many times. However, progress has been slow. Today there are about 3.5m units in operation, primarily in industrial applications. Globally, there are around 1,000 people employed for every robot. Even in South Korea, which has the world’s highest robot density, there are still roughly 100 times more humans as robots in the workplace, according to McKinsey. Robots may be present, but they have had little impact.

Forget robots. Instead, think of humanoids, or robots that increasingly resemble humans in their capabilities. Historically, the fields of robotics and AI have been separate. Their convergence is driving the real robot revolution. In the future, robots will look, act and think much like people. Owning a robot may be as commonplace as having a mobile phone or a car today. Listen to Elon Musk (admittedly an innovator who does not shy from making bold predictions) and robots will “far outnumber” humans by 2040.

For humans, activities such as walking across a busy room or picking an item are routine, requiring little mental effort. Yet these actions are remarkably complex, requiring the body to sense and respond to a mix of visual and haptic cues. Programming a machine to achieve human-like movement in unstructured environments is difficult with conventional methods. Now, with the rapid emergence of generative AI, manufacturers have been able to dramatically improve robots’ ability to perform these tasks.

Think of the next wave of AI as being physical AI, or an artificial intelligence that “understands the words of physics and can work among us”, in the words of NVIDIA’s Jensen Huang. ‘Embodied AI’ could be another apt description. Take sensors, actuators, batteries, power electronics, sophisticated 3D printing and now add in advanced software. The humanoid robot is on its way. AI has the potential to be transformational in terms of the way in which robots learn to move and navigate environments. They are picking up skills faster than ever before and adapting in ways previously thought impossible. Robots now have the ability to learn from direct observation and experience in the field. Put simply, perception and action are derived from data collection.

Several large-language training models (or VLAMs – ‘vision-language-action-models’) have already been developed. Expect more. Take the RT-X Model. This is the world’s largest open-source robotic data set. It includes over 1m robot trajectories (or potential paths that a robot might follow while performing a task) covering over 20 different robot types. Apply these learnings to any new robot model, and it can achieve up to a 50% improvement in task completion relative to more conventional training methods. Or consider NVIDIA’s Project GR00T, a general-purpose foundational model. It is specifically designed to facilitate humanoid robot learning in the real world. The model empowers robots to replicate human movements through observing action and videos. The benefits are improved coordination, dexterity and task completion. Similar to how iPhones receive new over-the-air software updates, so can robots, enabling more tasks and activities.

Have no doubt, we need humanoid robots. By mid-century, the global population of people aged 60 years and older will double, topping 2.1bn. Furthermore, the number of persons aged 80 years or older is expected to triple, reaching 426m by 2050, according to data from the World Health Organisation. 29% of the US workforce is comprised of boomers (born between 1946 and 1964) that will soon retire. Goldman Sachs estimates that there is expected to be a 4% shortage in US manufacturing labour and a 2% shortfall in global elderly care provision by 2030. Robots can fill the gap. Humanoids will not only work in factories but also care for the elderly.

The potential for humanoids to revolutionise a broad swathe of industries should be clear. Humanoids should be able to work lengthy days, or potentially non-stop (were they to have swappable battery packs and/or tethered power). Further, they require only a tiny fraction of supporting workplace expenditures required by humans, such as bathrooms, food, parking spaces, insurance, healthcare, pensions and so on. Apart from minimal downtime for maintenance, they should work without vacation, illness or complaint. In theory, they could be deployed instantly to perform any new task, with significantly reduced administrative costs. Even today, they can also speak (and translate from/to) any language.

Look around and you will see humanoids increasingly visible in multiple diverse workplaces. Current models are typically bipedal with five fingers, creating some similarities with humans and requiring minimal workplace reconfiguration. The latest models are capable of movements as precise as of 0.001mm, which give them the skills required in most high-performance jobs (according to the Bureau of Labor Statistics) and provide them with adaptive control to navigate unpredictable environments.

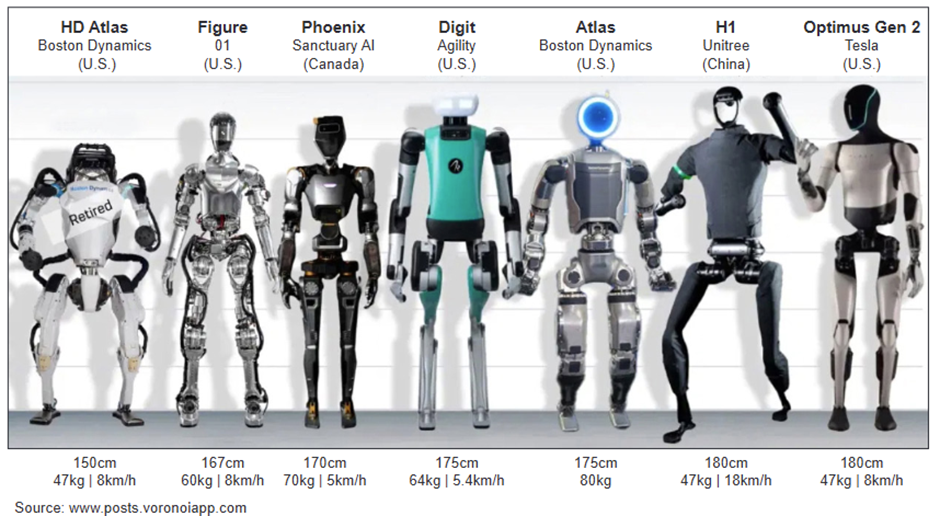

Visit many car factories (admittedly the among the earliest adopters of conventional industrial robots) and you will see humanoids at work. BMW's newest autoworker (made by Figure and profiled above) is 167cm tall, weighs 59kg, walks on two legs, uses five-fingered hands to assemble machines – and takes a break every five hours to stroll to a charging station and plug itself in. Mercedes and Magna International are also using robots, as is Tesla, unsurprisingly. Anecdotally, 90% of its Model 3 is now made by robots.

Take fulfilment centres as another clear use case. Both Amazon and GXO Logistics have started to trial robots (and deploy, in the case of Amazon) in a handful of the warehouses they operate. Robots, such as those made by Reflex, can pick 15kg bins and lift them onto conveyer belts more quickly and safely than their human counterparts. If weight is a consideration, then think of how humanoids could operate on construction sites. Here, they could perform better than humans in more dangerous environments, such as operating at height. Window-cleaning skyscrapers? Skyline Robotics has it covered. Equally, humanoids could be deployed to monitor and maintain remotely distributed assets such as power, water and telecoms infrastructure that are currently difficult for humans to oversee safely.

Healthcare constitutes another major end-market that could be potentially disrupted, particularly in terms of caring for the elderly, not to mention the company that they could provide too. Humanoids could be designed to assist healthcare professionals in physical tasks such as lifting and moving patients, as well as aiding with mobility and retrieving and delivering equipment. Such outcomes would not only help reduce the strain and potential injuries on healthcare workers but can also enhance the overall quality of patient care. Elsewhere, the Perceptive robot is said to be able to perform dental procedures faster and more accurately than its human counterparts.

Project even further ahead and humanoids could, theoretically, be deployed in a military capacity or even be deployed to help build new worlds on other planets (Mr Musk is an advocate of the latter scenario). Consider that today’s humanoids are the most expensive and least capable than they will ever be. Unit costs can vary between $30,000 and $150,000 depending on the model but have already fallen by over a third in the last year, according to research by Goldman Sachs. Payback periods will clearly improve with lower costs. Equally, humanoid capabilities should only grow from here. Against this background, as the industry scales, the marginal cost of adding one additional robot to the workforce should move close to zero.

The humanoid robot market is currently worth $1.3bn, but it is currently growing at three times the rate of the conventional robotics market, based on analysis by Goldman Sachs. On its projections, the market could be worth $38bn in a decade’s time. Humanoid robotic manufacturers are, unsurpsingly, more bullish. Given that labour compensation typically accounts for around 50% of a nation’s GDP, then the potential addressable market for humanoid robots could be as much as $50tr (using a 2023 world GDP figure of $105tr). It will, of course, take a long time to get there.

Herein lies the problem. Advocates would argue that humanoids are productivity enhancers, or complements, rather than replacements. They should allow humans to perform more value-added tasks. Humanoids can also alleviate strains on an ageing population. None of this, however, may prevent an inevitable backlash in some quarters. Beyond the risk of job losses, concerns have been raised about the risk of potential robotic ‘hallucination’, leading to tasks being performed incorrectly or with disastrous consequences. Any LLM that powers a humanoid robot will only be as good as the data on which it is trained. Then there are legal, ethical and security considerations that will need to be combined with the extent to which humans may be comfortable with robots having access to personal data, particularly should it relate to healthcare.

None of these issues is novel. Luddites often make the crucial mistake in failing to appreciate fully that humanoids will disrupt tasks more than jobs. Similarly, the risk of robots getting out of control is based on a misperception around their sentience. For us, the more critical debate is should be centred around the alignment of expectations. Make clear what robots can do at the outset so as to minimise the scope for potential disappointment. Do not anthropomorphise or over-generalise about what humanoids can do. There is also the more practical and mundane consideration that most humanoids can currently only work for limited periods of time before requiring recharging. This may constrain their abilities, although improvements are occurring at an exponential pace.

Given the secular challenge of an ageing population and a shrinking workforce, it is appropriate to pose the counterfactual: what might be the (next) best available alternative to having humanoid robots? In our view it behoves countries logically to be addressing these challenges now rather than before it is too late. Early adopters could see clear productivity gains to both their business and the broader economy. Expect also a potential race between different countries (especially the US and China) to develop technological standards and to seek to roll their robots out to other regions.

Investors need to pay attention now. Although the industry may be some way off reaching scale, it is clearly preparing for lift-off. Over $11bn of venture capital funding flowed into the humanoid robot industry during 2024, according to Pitchbook. Beyond the multiple start-ups present in the field (some were referenced previously in the report, and others would include Agility, Apptronik, Engineered Arts and 1X Technologies as well as Unitree in China), major tech businesses such as Amazon, Microsoft, NVIDIA and Samsung are involved in various robot projects. Existing players in the robotic market such as FANUC, Hyundai, Keyence and Toyota are also seeking to expand into the humanoid arena. Other potential beneficiaries could include enablers, or the providers of critical components such as actuators, sensors and LIDAR (vision) systems.

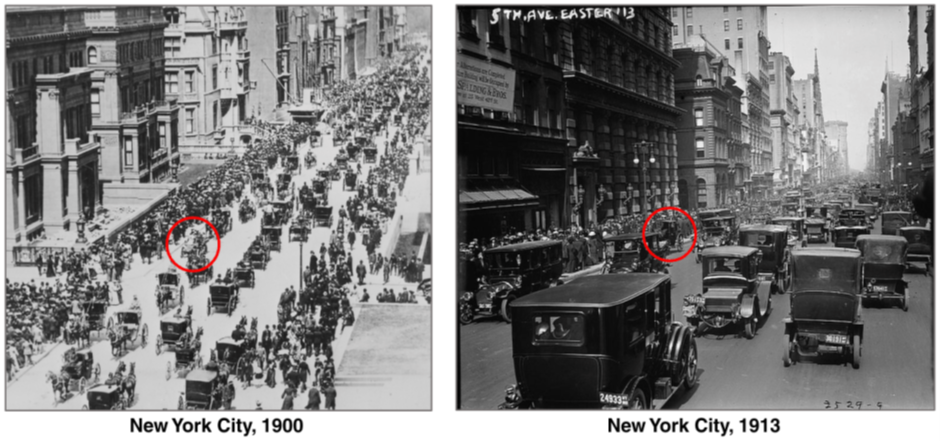

The analogy of the horse and the car may be a salutary one. Project back to 5th Avenue in 1900 and 95% of all transportation was provided by horses. Less than 15 years later it’s almost impossible to spot any horses. The robots may finally be coming.

10 February 2025

The above does not constitute investment advice and is the sole opinion of the author at the time of publication. Past performance is no guide to future performance and the value of investments and income from them can fall as well as rise.

Alex Gunz, Fund Manager, Heptagon Capital

Disclaimers

The document is provided for information purposes only and does not constitute investment advice or any recommendation to buy, or sell or otherwise transact in any investments. The document is not intended to be construed as investment research. The contents of this document are based upon sources of information which Heptagon Capital LLP believes to be reliable. However, except to the extent required by applicable law or regulations, no guarantee, warranty or representation (express or implied) is given as to the accuracy or completeness of this document or its contents and, Heptagon Capital LLP, its affiliate companies and its members, officers, employees, agents and advisors do not accept any liability or responsibility in respect of the information or any views expressed herein. Opinions expressed whether in general or in both on the performance of individual investments and in a wider economic context represent the views of the contributor at the time of preparation. Where this document provides forward-looking statements which are based on relevant reports, current opinions, expectations and projections, actual results could differ materially from those anticipated in such statements. All opinions and estimates included in the document are subject to change without notice and Heptagon Capital LLP is under no obligation to update or revise information contained in the document. Furthermore, Heptagon Capital LLP disclaims any liability for any loss, damage, costs or expenses (including direct, indirect, special and consequential) howsoever arising which any person may suffer or incur as a result of viewing or utilising any information included in this document.

The document is protected by copyright. The use of any trademarks and logos displayed in the document without Heptagon Capital LLP’s prior written consent is strictly prohibited. Information in the document must not be published or redistributed without Heptagon Capital LLP’s prior written consent.

Heptagon Capital LLP, 63 Brook

Street, Mayfair, London W1K 4HS

tel +44 20 7070

1800

email london@heptagon-capital.com

Partnership No: OC307355 Registered in England and Wales Authorised & Regulated by the Financial Conduct Authority

Heptagon Capital Limited is licenced to conduct investment services by the Malta Financial Services Authority.

Receive the updates

Sign up to our monthly email newsletter for the latest fund updates, webcasts and insights.

.png)

.jpg)